Step-by-Step Legal Guide to Forming a Company in Istanbul

Summary

This article walks you through all the legal steps, required documents, and tax obligations for both domestic and foreign individuals or entities to establish a Limited Liability Company (LLC) or Joint-Stock Company (JSC) in Istanbul.

1. Choosing Your Company Type

Limited Liability Company (LLC)

- Minimum capital: 10,000 TRY

- Shareholders: 1–50

Joint-Stock Company (JSC)

- Minimum capital: 50,000 TRY

- Shareholders: at least 1

Legal Basis

- Turkish Commercial Code No. 6102

- Ministry of Trade Communiqués

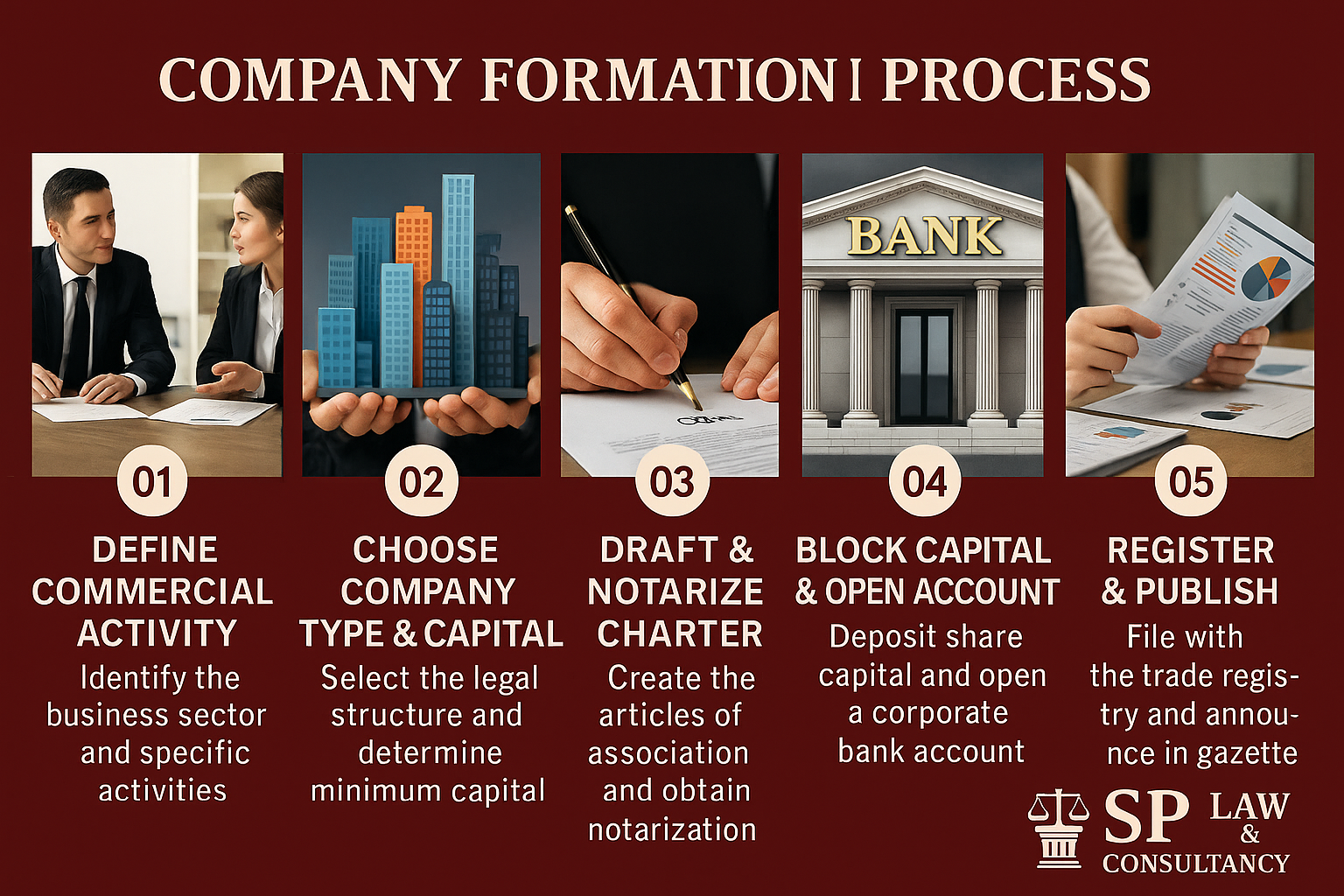

2. Step-by-Step Formation Process

| Step | Action | Responsible Authority |

|---|---|---|

| 1 | Submit Articles of Association for approval | Istanbul Chamber of Commerce |

| 2 | Register for a Tax ID | Turkish Revenue Administration |

| 3 | File Social Security Enrollment (partners/employees) | Social Security Institution (SGK) |

| 4 | Publish in Trade Registry Gazette | Official Gazette |

| 5 | Notarize Company Ledgers (journal, ledger) | Notary Public |

| 6 | Notarize Signature Circular | Notary Public |

3. Required Documents

- IDs or passports of founding partner(s)

- Proof of residence (domicile certificate)

- Signature circular(s)

- Bank receipt showing 25 % of paid-in capital

- Draft Articles of Association

4. Tax & Regulatory Obligations

- Corporate Tax: 25 % (as of 2025)

- Withholding Tax & VAT Declarations

- VAT Exemption: until first issued invoice

5. Frequently Asked Questions

- Q: Why choose an LLC over a sole proprietorship?

- A: Better liability protection and clearer corporate structure.

- Q: Are there extra steps for foreign shareholders?

- A: Yes—apostilled documents and a valid residence permit are required.